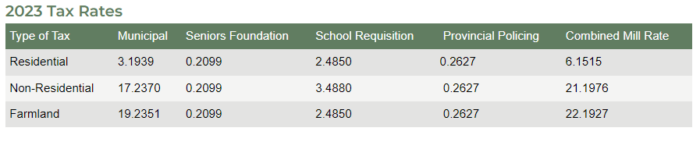

Taxes & Incentives

Non-Residential Tax Incentive

The JEDI Region offers a tax incentive bylaw to encourage the development of non-residential properties in the County of Wetaskiwin. The tax incentive is calculated for three (3) years under a 50/30/10 rule. In the first year, the municipal tax payable is reduced by 50%; in the second year, the municipal tax payable is reduced by 30%; and in the third and final year the municipal tax payable is reduced by 10%. More information about the tax incentive bylaw can be found on the County’s website.

Corporate Taxes

The province of Alberta has a highly competitive corporate tax structure. It is the only province that does not have provincial retail sales tax, and there are no provincial payroll taxes, which are common in many other provinces.

A summary of Alberta taxes, levies and related programs and links to publications, forms and resources can be found here.

Provincial & Federal Incentives

Go to our Business Resources section to see what programs match your needs.